Company News

Newsroom

Leaders of Shenzhen Nanshan Venture Capital Company visited Nibo for investigation and cooperation

add time:2021-04-13On the morning of April 7th, two investment managers Zhang Junwei and Xian Siqiu from the Investment Department of Shenzhen Nanshan Venture Capital Co., Ltd. came to bring the Shenzhen headquarters of Shenzhen Nibo Electronics Co., Ltd. to investigate and discuss cooperation.

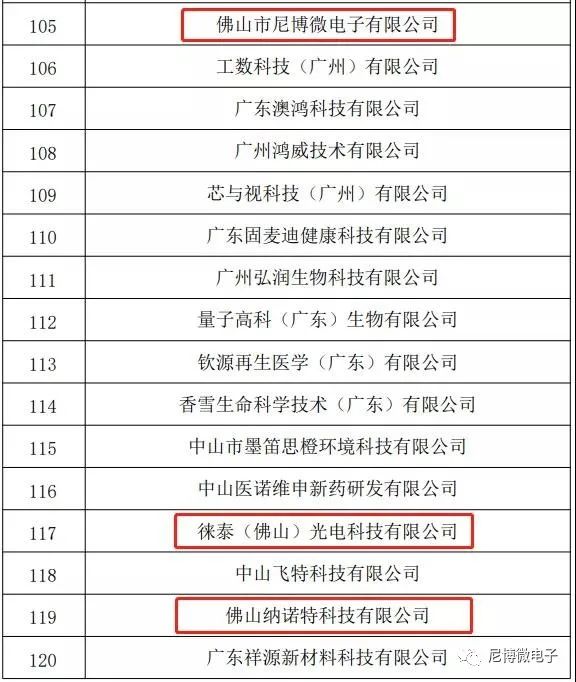

Chairman Zhou Zhanbo and General Manager Zeng Xuehui of Shenzhen Lieber Electronics Co., Ltd. received the guests. Chairman Zhou Zhanbo gave a detailed introduction to the development history and production and operation of Shenzhen Lieber Electronics Co., Ltd., and gave a detailed introduction to the company's semiconductor chip and motor drive product project layout plan. He said that Lieber Electronics Co., Ltd. this year With the rapid development of the domestic electronic and electrical industry, the company’s development pace has been further accelerated. This year, Foshan Lieber Microelectronics Co., Ltd. and Foshan Lieber Intelligent Technology Co., Ltd. were established in Foshan to deploy the chip industry and the motor drive industry respectively, and the development speed will be a new one. Steps. General Manager Zeng Xuehui introduced that Lieber has a strong technical development team. With its technological advancement, the company's products have achieved outstanding results in the electronic and electrical supporting industry. The company's semiconductor chips will make further efforts in domestic substitution in recent years. The market prospect is very broad.

Two leaders of the investment department of Shenzhen Nanshan Venture Capital Co., Ltd. introduced that Shenzhen Nanshan Venture Capital Co., Ltd., as a professional sub-fund management platform, pays great attention to cutting-edge technologies and innovative models, and focuses on investing in strategic emerging industries (bio , Internet, new energy, new materials, new generation of information technology, cultural creativity, energy saving and environmental protection), future industries (life and health, marine, aerospace, military, robotics, wearable, smart equipment), modern service industry, advantageous traditional industries In other fields, we will build a service system of “incubation + venture capital + mergers and acquisitions” to create a new ecosystem of venture capital services.